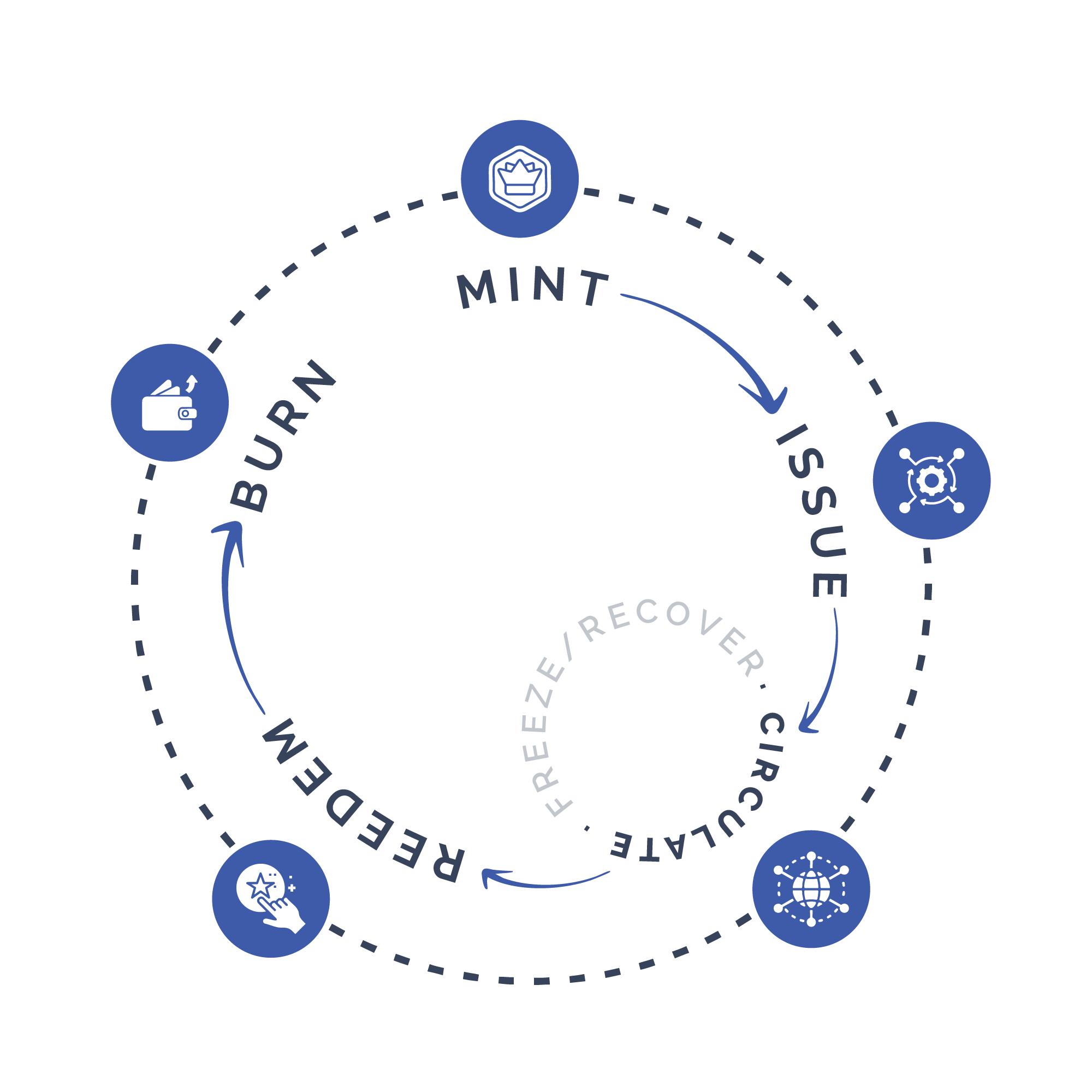

Stablecoin Lifecycle Management Platform

Bank-Grade, Regulatory-Compliant Infrastructure

100.000.000+

transactions

1.500.000+

wallets

200.000+

tx / day

€ 5.000.000.000+

tx volume - backed by real payments

Stablecoin Rails for Trading, Payments, Treasury & Digital Assets

Built for programmable money movement, liquidity optimization, and tokenized finance use cases.

Interbank Liquidity & Treasury

Enhance cross-border liquidity, treasury automation, and real-time stablecoin settlements for banks.

Institutional Trading & Capital Markets

Enable stablecoin-based settlement, liquidity optimization, and institutional-grade market operations.

Crypto Trading & DeFi Liquidity

Support decentralized trading, liquidity pools, and automated arbitrage with compliant stablecoins.

Across the Financial Spectrum

From banks, EMIs, and payment institutions to global card networks and corporate treasurers, NEXUS provides the trusted infrastructure for regulated digital money.

Our platform supports a wide range of institutions — including payment service providers (PSPs), centralized and decentralized exchanges, and public-sector actors — enabling them to issue, manage, and integrate stablecoins across global finance and Web3 ecosystems.

- Banks & Central Banks (CBDC)

- Electronic Money Institutions (EMIs)

- Payment Institutions & PSPs

- Card Networks & Issuers

- Centralized exchanges (CEXs)

- Decentralized finance platforms (DeFi)

- Social Media Platforms

- Treasurers

Multi-Chain Infrastructure for Compliant Stablecoin Issuance

Smart contract integration and cross-chain interoperability with automated regulatory alignment.

Smart Contract Integration

Enables Programmable Money

API-Driven Integration

Seamless REST APIs for legacy and Web3 systems

Compliant Wallet Management

KYC-linked wallet infrastructure with programmable trust levels

- Regulatory Alignment (MiCA, PSD2, AMLD)

- AML/KYC tools, GDPR-compliant architecture

- ISO 27001 certification

- ISAE 3402 Type 2 assurance

- DORA-aligned operational design