Solutions

For real-time money movement, embedded payments, and digital transactions.

Stablecoin Rails for Trading, Payments, Treasury & Digital Assets

Built for programmable money movement, liquidity optimization, and tokenized finance use cases.

B2B Corporate Payments

Enable cross-border and domestic enterprise payments using compliant stablecoins.

Treasury Management Operations

Optimize liquidity, internal transfers, and settlements through programmable stablecoin rails.

B2C eCommerce Payments

Accept and settle online payments instantly, securely, and cost-effectively with stablecoins.

Consumer Remittances

Enable fast, low-cost global transfers for individuals using regulated stablecoin infrastructure.

IoT and Micropayments

Power seamless device-to-device transactions and micro-commerce ecosystems.

Crypto Trading & DeFi Liquidity

Support decentralized trading, liquidity pools, and automated arbitrage with compliant stablecoins.

Institutional Trading & Capital Markets

Enable stablecoin-based settlement, liquidity optimization, and institutional-grade market operations.

Interbank Liquidity & Treasury

Enhance cross-border liquidity, treasury automation, and real-time stablecoin settlements for banks.

Loyalty & Rewards Programs

Tokenize loyalty points, cashback rewards, and partner network incentives using stablecoin rails.

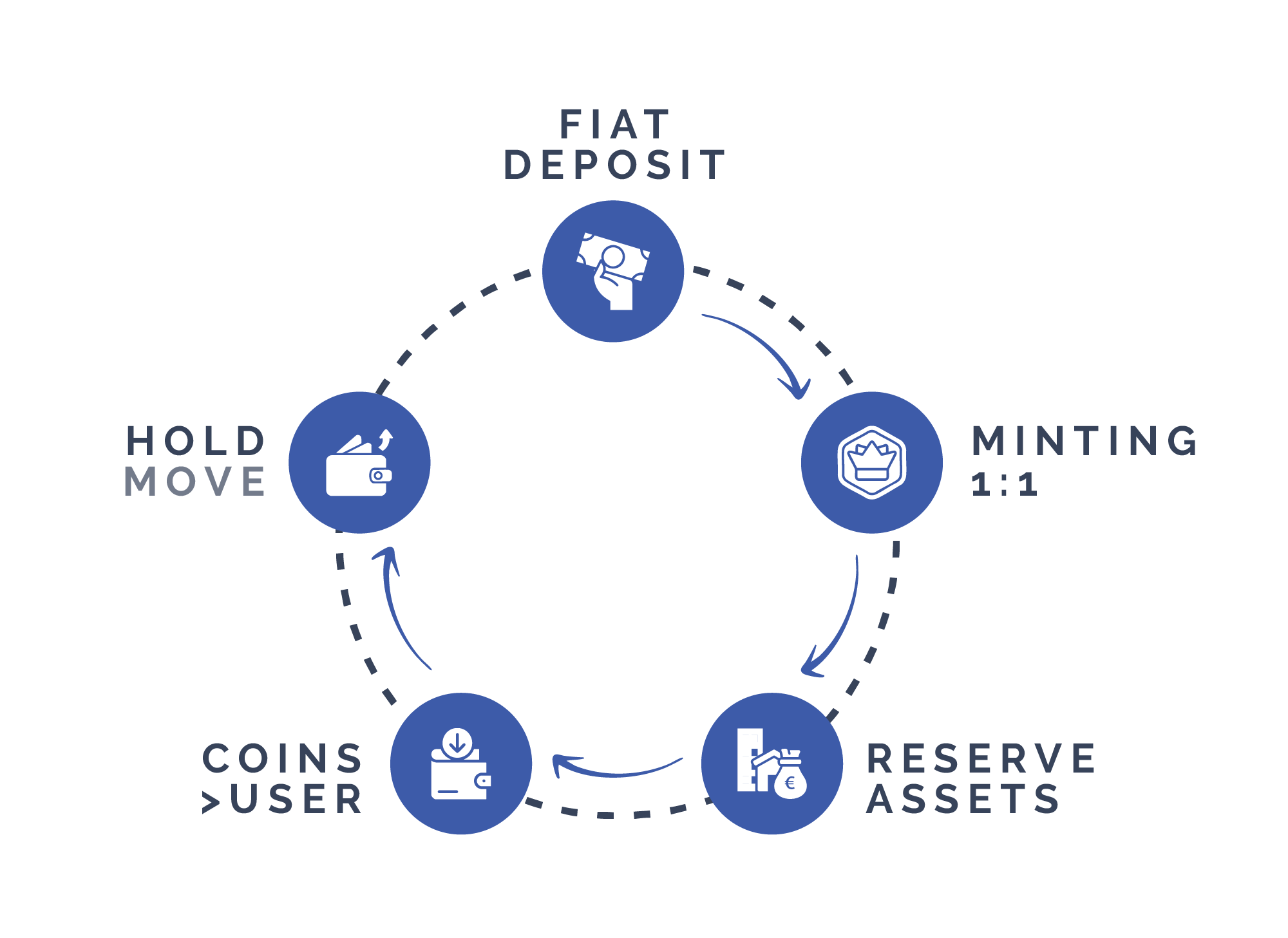

From deposits to stablecoins

- User initiates a fiat deposit (e.g. EUR) to the issuing entity’s designated account

- Issuer mints stablecoins on a 1:1 basis, backed by the corresponding fiat value in reserve

- Reserve assets are held in a mix of cash and low-risk instruments (e.g., short-term government bonds)

- Stablecoins are issued to the user’s wallet, representing a claim on the underlying reserve

- Users can move or hold stablecoins via self-custodial or custodial wallets, depending on infrastructure and compliance requirements